Concentrated Position Examples

Learn About IGA's Most Valuable Tailored Solutions

One of Income Growth Advisor’s most valuable tailored solutions is for executives with concentrated stock positions.

By structuring an option strategy to hedge a concentrated stock position through Interactive Brokers–with the industry’s lowest margin rates*–we can use the added borrowing capacity to invest in a diversifying income portfolio such as an MLP portfolio.

With a tailored option strategy IGA can create can:

- defer taxes normally triggered by a simple stock sale.

- allow for additional stock appreciation.

- allow for additional diversification

- and create additional income.

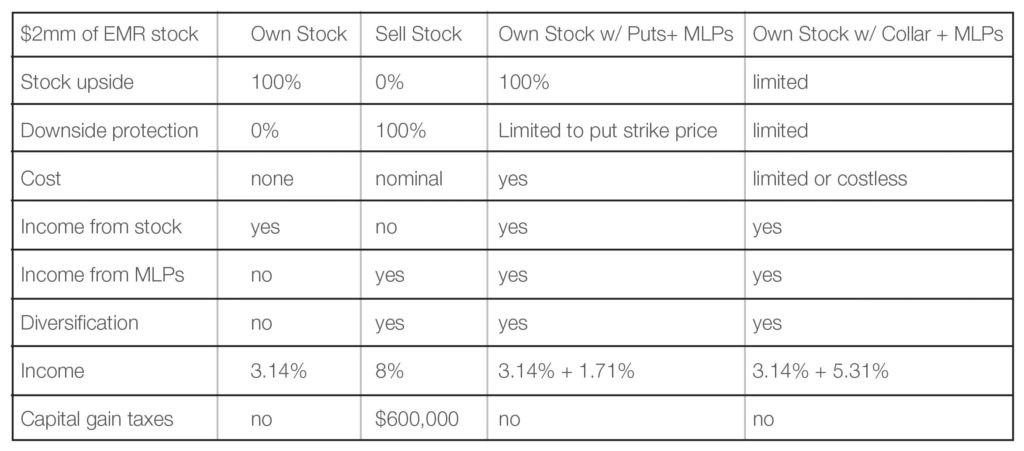

We analyzed an option strategy for an executive with Emerson Electric (EMR) stock and evaluated how his income and return profile changed. In this example,

- We increased client’s annual income by $34,182.

- We increased the client’s income by 1.71%/year

- Reduced the concentrated stock position risk by buying puts.

- Avoided a capital gain when compared to selling the stock.

- And retained the upside appreciation in his Emerson stock.

We analyzed using a collar strategy for the same executive with Emerson Electric (EMR) stock and evaluated how his income and return profile changed. In this example,

- We increased client’s annual income by $106,198.

- We increased the client’s income by 5.31%/year

- Reduced the concentrated stock position risk by buying puts.

- Avoided a capital gain when compared to selling the stock.

We significantly increased the client’s income by financing the put position through the sale of calls; however, in selling the calls, the client forgoes upside on the Emerson Electric (EMR) stock but significantly increases his income.

Consider the benefits of an option strategy and reinvesting the proceeds in MLPs:

A tailored option strategy, in combination with an MLP portfolio can

- Diversify your income

- Create substantial income for

- for retirement

- spouses, children, grandchildren, special needs

- charitable giving

Why IGA?

- Experience option trading1.

- Low cost execution through Interactive Brokers

- Low cost borrowing rates which make our tailored strategies far less expensive that major banks and brokerages

- Our MLP investment experience will allow us to create significant tax advantaged income streams with solid growth prospects.

- We may provide some the most competitive incremental income programs on Wall Street for clients seeking to diversify their holding and create non correlated income streams

Halsey has over 30 years option trading experience, having worked on the NY Futures Exchange in 1984, winning the USA Today CNBC National Investment Challenge in 1992 and having been the Managing Member of hedge funds using option strategies.

Disclaimer: Markets change and the benefit of any strategy will change with the markets. Hedging strategies may have tax consequences that should be reviewed with your tax advisor.

We made assumptions of 8% income for MLPs in April of 2017. As of Novermber 2017, MLP yields are higher and a higher assumed yield would be appropriate for income from an MLP portfolio. We assumed in this example the use of some MLP ETFs which yield more than MLPs in general but lack certain tax advantages of owning MLPs outright.

Owning MLPs have certain tax issues which should also be reviewed with your tax advisors. The benefit of our tailored strategy approach is we can structure return profiles that are tailored to your choice of the following: additional income, increased downside protection, upside potential in concentrated position.

Each stock will have its own option pricing and interest rates and markets change.

Because we can offer some of the lowest borrowing costs in the financial services industry and since out MLP portfolio performance offers and attractive high yield, we believe we have a unique competitive advantage in providing higher incremental income and lower costs than most of our competitors.

Invest with Income Growth Advisors

Create a financial road map for your investment objectives and risk tolerances.

Your bespoken investment plan awaits!