Concentrated Positions

Hedging with Costless Collar

With a costless collar, the premium for the calls equals the cost to buy the puts, making the transaction “costless”. The cost of margin interest and portfolio management remain. Using the $2,000,000 Emerson Electric stock (EMR) example, the income from the EMR stock and MLP portfolio would be the same.

Income Benefit:

- MLP portfolio income = 8% x $2mm x 669 days/365 days= $293,260 MLP income

- Total Income Benefit = $293,260

In the above case, the costs would be the same except the outright cost of the puts is not included:

Strategy Costs:

- Borrowing Cost: 1.69% x 2mm x 669/365= $61,951.

- Management fee 1% x $2,000,000 x 669/365 yr. = $36,657

- Total Strategy Costs = $61,951 + $36,657 = $98,608

Strategy Net Benefit:

- Income Benefit – Strategy costs cost= $293,260 – $98,608 = $194,652

- This example is based on a period of 669 days or 1.8329 years.

- The annual benefit is $106,198.

- Benefit versus Position $106,198/$2,000,000 = 5.31%/year additional income per year.*

*This is a hypothetical analysis based on a real EMR hedged analysis. In the collar example, the investor gives up upside appreciation, so a that the cost of the put is eliminated. In a real example, we would structure the option strategy and the call premium might be more or less than the put costs. If the call premium is less than the put, net proceeds to invest in an MLP strategy would be smaller and the income would be less.

However, we can tailor a strategy that fits your desired objective.

Background and assumptions:

In April 2017 an executive with $6,000,000 Emerson Electric stock contacted us about an MLP portfolio. We identified his concentration of assets in the single stock and showed how he could increase his income, reduce his stock risk and defer taxes through option strategies and hedge $2,000,000 in EMR stock through Interactive Brokers.

Assumptions:

- Stock Emerson Electric (EMR)

- Amount $2,000,000

- EMR Dividend 3.14% annum.

- Hedged period 1.83 years 669 days.

- Interactive Brokers Margin 1.69% on $2,000,000

The Costless (Zero-Cost) Collar

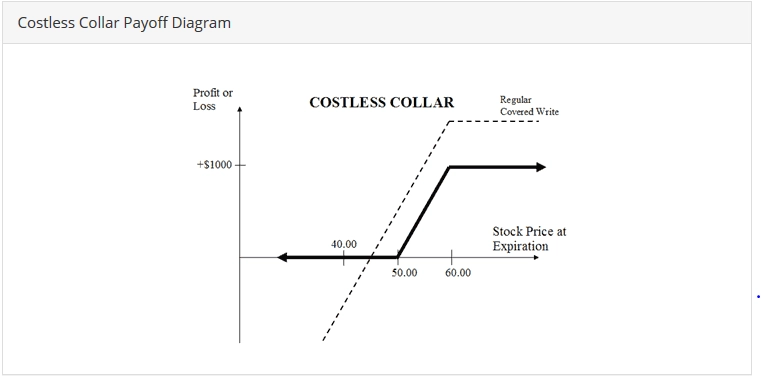

Suppose the stock XYZ is currently trading at $50 in June ’18. An options trader holding on to 100 shares of XYZ wishes to protect his shares should the stock price take a dive. At the same time, he wants to hang on to the shares as he feels that they will appreciate in the next 6 to 12 months. He setups a costless collar by writing a one year JUL ’19 60 LEAPS call for $5 while simultaneously using the proceeds from the call sale to buy a one year JUL ’19 50 LEAPS put for $5.

If the stock price rally to $70 at expiration date, his maximum profit is capped as he is obliged to sell his shares at the strike price of $60. At 100 shares, his profit is $1000. On the other hand, should the stock price plunge to $40 instead, his loss is zero since the protective put allows him to still sell his shares at $50.However, should the stock price remain unchanged at $50, while his net loss is still zero, he would have ‘lost’ one year’s worth of premiums of $500 that would have been collected if not for the protective put purchase.

The costless collar is an options strategy designed to give you bit of extra profit potential, while also capping downside risk. This is accomplished by buying a put option with a strike price at or below the current price of your stock holding, as well as selling (writing) a call option with a strike price above the current stock price.

The put is a cash outlay, as you must pay the premium. The put option caps your downside at whatever the strike price of the put option is.To cover the cost of the put, sell a call option. For this you will receive a premium. The call option caps your upside on the stock position to the level of the call strike price. The strategy can be utilized on short-term positions as well as long-term positions. Longer-term traders use LEAPS (Long Term Equity Anticipation Security), which are simply options that can be purchased for distant dates in the future.

Another example of a Costless Collar:

Costless Collar Considerations

You may face some issues implementing a real-world costless options strategy. It’s rare to find a costless collar that gives significant upside potential while keeping your downside very low. In order for the strategy to be costless, you may only get an extra 5% of upside for example, while risking 7% to 10% (varies) on the downside. In the example above our upside potential was 4.74% ($4.76/$100.24), while the downside was 5.93% ($5.95/$100.24).

A costless collar is also typically aimed at investors, because a short term trader is more likely to just sell the stock if unsure of the position. Therefore, the investor is buying an option that expires several months or more into the future. Unless the stock is very well known and heavily traded, there may not be volume in options several months out. If no one else is trading LEAPS in the stock, it isn’t possible to construct a costless collar. Use the strategy if you want to exit the stock position eventually, but want to try to make a bit more money in the meantime. If you don’t want to lose your equity position, don’t use this strategy

Compute what your upside and downside would be if you executed a costless collar based on current option premiums. Only make the trade if you are comfortable with capping your upside and risk (and the strike prices you can do this at) and potentially being forced to exit the position if the options are exercised.

The Bottom Line

By buying a put with a strike below the current price, and selling a call above the current price, you create a costless collar options strategy. It caps your risk and profit on a stock holding, so it’s best suited to investors who eventually want to exit a position anyway but want to see if they can get a bit more out of it first. In the real-world, put and call options usually won’t have the same price. This means there may be a small cost or profit made when creating the “costless” collar.

Disclaimer: Markets change and the benefit of any strategy will change with the markets. Hedging strategies may have tax consequences that should be reviewed with your tax advisor.

We made assumptions of 8% income for MLPs in April of 2017. As of Novermber 2017, MLP yields are higher and a higher assumed yield would be appropriate for income from an MLP portfolio. We assumed in this example the use of some MLP ETFs which yield more than MLPs in general but lack certain tax advantages of owning MLPs outright.

Owning MLPs have certain tax issues which should also be reviewed with your tax advisors. The benefit of our tailored strategy approach is we can structure return profiles that are tailored to your choice of the following: additional income, increased downside protection, upside potential in concentrated position…

Each stock will have its own option pricing and interest rates and markets change.

Because we can offer some of the lowest borrowing costs in the financial services industry and since out MLP portfolio performance offers and attractive high yield, we believe we have a unique competitive advantage in providing higher incremental income and lower costs than most of our competitors.

Invest with Income Growth Advisors

Create a financial road map for your investment objectives and risk tolerances.

Your bespoken investment plan awaits!