Highest Quality

MLPs Least Likely to Cut Their Distribution or Go Bankrupt.

The highest quality profile is designed for MLP owners who want sleep comfortable knowing they own these holdings for their retirement income.

Highest Quality MLP investors want to own companies which will not get into trouble and can be trusted to deliver steady income. These MLPs will sacrifice risk and return so you can depend on their income retirement living expenses. The MLPs in this profile will have less leverage and more growth than MLPs the Blue Chip Total Return profile. The Highest Quality MLPs will have some of the highest distribution coverage ratios and most stable business models when compared to other MLPs.

We typically have 8 MLP holdings in a profile. To augment our security selection process, we developed quantitative models to identify the most attractive MLPs which would qualify for the highest quality.

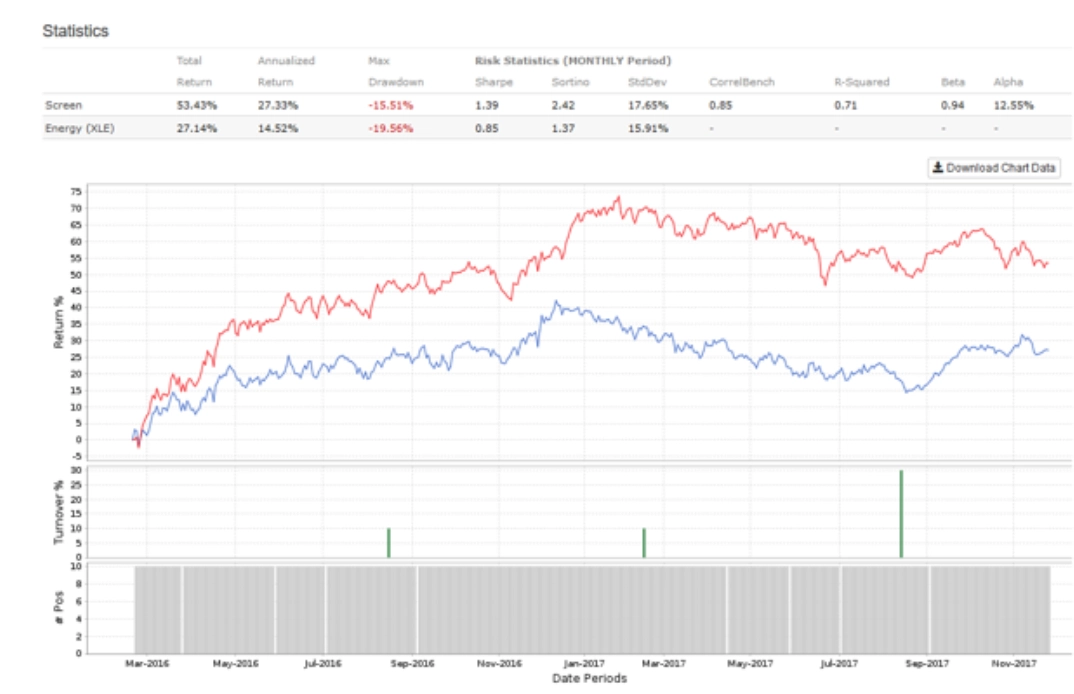

Below is a back-tested return profile based on our proprietary quantitative rules and inputs since March 2016 when oil and the sector and bottomed. We use quantitative methods to identify factors that explain performance but are careful not to use those characteristics which historically fit, but are not forward looking. The Highest Quality model below reflects a 27.3% annualized return which outpaces the XLE energy index which annualized 14.52%. This model has an alpha of 15.5%, a sharp ratio of 1.39 and lower maximum drawdown than the XLE benchmark.

Representative Highest Quality MLP Holdings

MPLX LP (MPLX) is a diversified, growth-oriented master limited partnership formed in 2012 by Marathon Petroleum Corporation that owns, operates, develops and acquires midstream energy infrastructure assets. MPLX is engaged in the gathering, processing and transportation of natural gas; the gathering, transportation, fractionation, storage and marketing of NGLs; and the transportation, storage and distribution of crude oil and refined petroleum products. The company’s assets include approximately 2,900 miles of crude oil and refined product pipelines across 9 states; interest in a butane cavern located in Neal, West Virginia with approximately 1,000 thousand barrels of storage capacity. Headquartered in Findlay, Ohio, MPLX’s assets consist of a network of crude oil and products pipeline assets located in the Midwest and Gulf Coast regions of the United States. MPLX’s market capitalization is $16 billion and yields 6.8%.

EQT Midstream Partners, LP (EQM) is a growth-oriented limited partnership formed by EQT Corporation (EQT) to own, operate, acquire and develop midstream assets in the Appalachian Basin. EQM provides midstream services to EQT and multiple third parties across Pennsylvania and West Virginia through its two primary assets: the transmission and storage system, which serves as a header system transmission pipeline, and the gathering system, which delivers natural gas from wells and other receipt points to transmission pipelines. EQM provides substantially all its natural gas transmission, storage and gathering services under contracts with long-term, firm reservation and/or usage fees. This contract structure enhances the stability of EQM’s cash flows and limits its direct exposure to commodity price risk. The company’s market capitalization is $5.59 billion and yields 5.92%.

Shell Midstream Partners, L.P. (SHLX) is a fee-based, growth-oriented master limited partnership formed by Royal Dutch Shell, plc “Shell”–one of the largest energy and petrochemical companies in the world. SHLX owns, operates, develops and acquires pipelines and other midstream assets in the United States. The company owns crude oil and refined products pipelines which serve as key infrastructure to transport growing onshore and offshore crude oil production to Gulf Coast refining markets. The company generates substantially all its revenue under long-term agreements by charging fees for the transportation of crude oil and refined products through our pipelines. SHLX’s market capitalization is $5.3 billion and yields 4.96%.

Price and Yield data as of 12/1/2017

Invest with Income Growth Advisors

Create a financial road map for your investment objectives and risk tolerances.

Your bespoken investment plan awaits!