High Yield

The Highest Yield MLPs Which do not Appeal at Imminent Risk of Cutting Their Dividend.

High Yield may be out of favor MLPs with high debt but do not look like they are at immediate risk of cutting their distribution.

High Yield are those MLPs that may be restructuring after a distribution cut and are recovering from a deeply oversold with distributable cash flow to support future distributions. High Yield MLPs may simply be in a subsector which is out of favor and does not have any tangible growth prospects.

We typically have 8 MLP holdings in a profile. To augment our security selection process, we developed quantitative models to identify the most attractive MLPs from those which would qualify as High Yield.

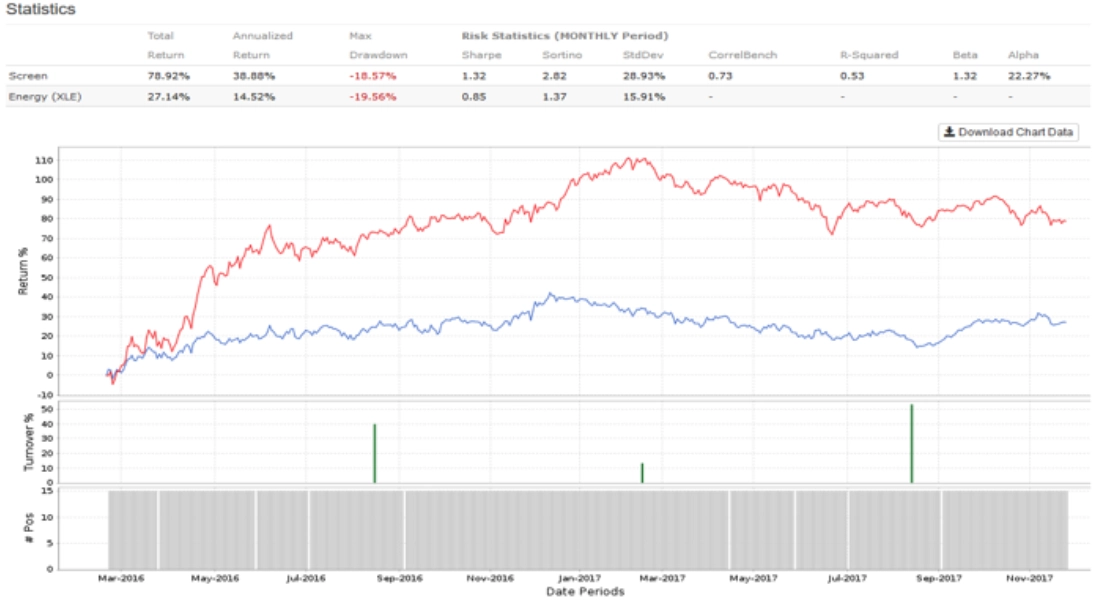

Below is a back-tested return profile based on our proprietary quantitative rules and inputs since March 2016 when oil and the sector and bottomed. We use quantitative methods to identify factors that explain performance but are careful not to use those characteristics which historically fit, but are not forward looking. The High Yield model below reflects a 38.88% annualized return which outpaces the XLE energy index which annualized 14.52%. This model has an alpha of 22.27%, a sharp ratio of 1.32 and lower maximum drawdown than the XLE benchmark.

Representative High Yield Holdings

American Midstream Partners, LP (AMID) provides midstream infrastructure that links the producers of natural gas, crude oil, natural gas liquids (NGLs), condensate, and specialty chemicals to various intermediate and end-use markets in the United States. The company recently merged with JP Energy and is actively restructuring. AMID does not have a traditional parent, but is funded and supported by ArcLight Capital Partners, LLC a private equity firm that has invested in over $19 billion in energy assets. AMID owns approximately 4,000 miles of interstate and intrastate pipelines, as well as ownership in gas processing plants, fractionation facilities, and an offshore semisubmersible floating production system with nameplate processing capacity of 80 thousand barrels per day of crude oil and 400 million cubic feet per day of natural gas. AMID has terminal sites with approximately 6.7 million barrels of storage capacity. American Midstream Partners, LP has a market capitalization of $642 million, a 12.4% yield and was founded in 2009 and is headquartered in Houston, Texas.

Crestwood Equity Partners LP (CEQP) provides infrastructure solutions to liquids-rich natural gas and crude oil shale plays in the United States. The company owns and operates natural gas facilities with approximately 2.5 billion cubic feet of natural gas/day (Bcf/d) of gathering capacity and 516 million cubic feet of natural gas/day of processing capacity; NGL facilities with approximately 20,000 Bbls/d of fractionation capacity and 2.8 million barrels of storage capacity, as well as a portfolio of transportation assets with a capacity of transporting approximately 294,000 Bbls/d of NGLs; and crude oil facilities with approximately 125,000 Bbls/d of gathering capacity, 1.5 million barrels of storage capacity, 48,000 Bbls/d of transportation capacity, and 160,000 Bbls/d of rail loading capacity, as well as 79.3 Bcf of certificated working storage capacity and 1.4 Bcf/d of pipeline transportation capacity.

In June 2016 Crestwood Equity formed a joint venture with Consolidated Edison, Inc. (NYSE: ED), named Stagecoach Gas Services LLC, to own and develop natural gas pipeline and storage assets in the Northeast. As part of the transaction, Crestwood Equity received approximately $975 million for 50% of its existing Northeast pipeline and storage assets contributed to the joint venture. This transaction deleveraged CEQP’s balance sheet as part of a successful restructuring. The company was formerly known as Inergy L.P. and changed its name to Crestwood Equity Partners LP in October 2013. The company was founded in 2001 and is headquartered in Houston, Texas. Its Market capitalization is $1.716 billion and yields 10.21%. Crestwood Equity Partners LP is a subsidiary of Crestwood Holdings LLC.

DCP Midstream, LP, (DCM) is a master limited partnership and one of the largest NGL producers and gas processors in the United States. The company has a $5.16 billion market capitalization and 9.41% yield. DCM owns, operates, acquires and develops a portfolio of midstream energy assets in the United States. The company owns and operates approximately 60 plants and 63,000 miles of natural gas and natural gas liquids pipelines with operations in 17 states. It serves retail and wholesale propane customers, refining and petrochemical companies, and NGL marketers operating in the liquid hydrocarbons industry. DCP Midstream GP, LP serves as the general partner of the company. The company was formerly known as DCP Midstream Partners, LP and changed its name to DCP Midstream, LP in January 2017. DCP Midstream, LP was founded in 2005 and is headquartered in Denver, Colorado.

Price and Yield data as of 12/1/2017

Invest with Income Growth Advisors

Create a financial road map for your investment objectives and risk tolerances.

Your bespoken investment plan awaits!