Concentrated Positions

Hedging with Puts and Investing in MLPs

One of Income Growth Advisor’s most valuable tailored solutions is for executives with concentrated stock positions. By structuring an option strategy to hedge a concentrated stock position through Interactive Brokers–with the industry’s lowest margin rates*–we can use the added borrowing capacity to invest in a diversifying income portfolio such as an MLP portfolio.

With a tailored option strategy IGA can create can:

- Defer taxes normally triggered by a simple stock sale.

- Allow for additional stock appreciation.

- Allow for additional diversification

- and create additional income.

We analyzed an option strategy for an executive with Emerson Electric (EMR) stock and evaluated how his income and return profile changed. In this example,

- We increased client’s annual income by $34,182.

- We increased the client’s income by 1.71%/year

- Reduced the concentrated stock position risk by buying puts.

- Avoided a capital gain when compared to selling the stock.

- and retained the upside appreciation in his Emerson stock.

In April 2017, an executive with $6,000,000 Emerson Electric stock contacted us about an MLP portfolio. We identified his concentration of assets in the single stock and showed how he could increase his income, reduce his stock risk and defer taxes through option strategies and hedge $2,000,000 in EMR stock through Interactive Brokers.

Assumptions:

- Stock Emerson Electric (EMR)

- Amount $2,000,000

- EMR Dividend 3.14% annum.

- Hedged period 1.83 years 669 days.

- Interactive Brokers Margin 1.69% on $2,000,000

Hedge with puts:

While deferring the tax consequence of selling his stock, the executive was able to maintain upside stock potential, secure downside protection with his put position and add $34,184 (1.71%/year) in additional annual income to his position.

Strategy Costs:

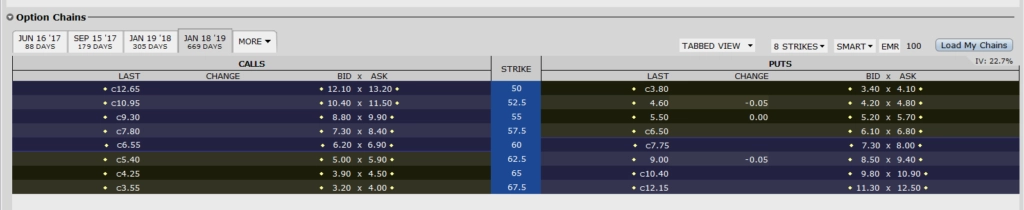

- Hedging Cost: 1/3 of your position is 33,000 shares. You would buy 330 options (each correspond to 100 shares.) 330 x $4 x 100 shrs/option contract =$132,000.

- Borrowing Cost: 1.69% x 2mm x 669/365= $61,951.

- Management fee 1% x $2,000,000 x 669/365 yr. = $36,657

- Total Strategy Costs = $132,000 + $61,951 + $36,657 = $230,608

Income Benefit:

- MLP portfolio income = 8% x $2mm x 669 days/365 days= $293,260 MLP income

- Total Income Benefit = $293,260

Strategy Net Benefit:

Income Benefit – Strategy costs = $293,260 – $230,608 = $62,652. Since this example is based on a period of 669 days or 1.83 years, the annual benefit is $34,182. Net income benefit versus EMR position $34,236/$2,000,000 = 1.71%/year.

The executive also:

- Reduced the concentrated stock position risk.

- Avoided a capital gain when compared to selling the stock.

- Retained upside appreciation.

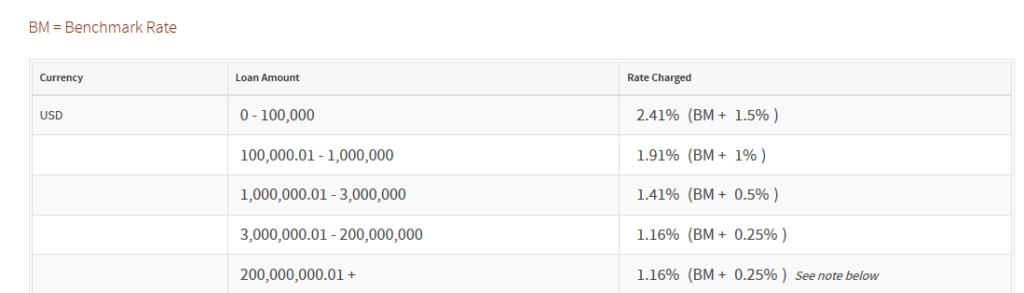

* Borrowing cost: from Interactive Brokers April 2017. See www.IBKR.com for updated rates.

BM is the Fed Fund rate. So 2,000,000 is 91 bp (Fed Funds) + 50 bp. (If rates go up so will the cost of the borrowing.)

Borrowing Cost:

BM is the Fed Fund rate. So 2,000,000 is 91 bp (Fed Funds) + 50 bp (If rates go up so will the cost of the borrowing.)

Option Pricing for EMR at Time of Example April, 2017

Disclaimer: Markets change and the benefit of any strategy will change with the markets. Hedging strategies may have tax consequences that should be reviewed with your tax advisor.

We made assumptions of 8% income for MLPs in April of 2017. As of Novermber 2017, MLP yields are higher and a higher assumed yield would be appropriate for income from an MLP portfolio. We assumed in this example the use of some MLP ETFs which yield more than MLPs in general but lack certain tax advantages of owning MLPs outright.

Owning MLPs have certain tax issues which should also be reviewed with your tax advisors. The benefit of our tailored strategy approach is we can structure return profiles that are tailored to your choice of the following: additional income, increased downside protection, upside potential in concentrated position.

Each stock will have its own option pricing and interest rates and markets change.

Because we can offer some of the lowest borrowing costs in the financial services industry and since out MLP portfolio performance offers and attractive high yield, we believe we have a unique competitive advantage in providing higher incremental income and lower costs than most of our competitors.

Invest with Income Growth Advisors

Create a financial road map for your investment objectives and risk tolerances.

Your bespoken investment plan awaits!