Persistent Inflation Threatens Four Decades of Investor Prosperity

The execution of the Fed’s reversal of its accommodating policy will dictate stock and bond market’s performance in 2022. In 2022, the “TINA” trade or There Is No Alternative argument for overpriced equities will collapse. “Bull markets are born on pessimism, grow on skepticism, mature on optimism, and die on euphoria” said investor, Sir John […]

Uncontrollable Inflation Threatens Four Decades of Prosperity

The 60/40 model is broken. Inflation is rising rapidly, and the Fed is scrambling. Inflation and Fed taper end 40 year bond bull market. Fed’s balance sheet expansion reversal will hurt. Rotate away from large cap growth and bonds. After forty years of declining interest rates the 60% 40% stock bond allocation model is broken. […]

The Great Malaise: Stagflation and the Great Rotation in the 2020s

Decelerating tech momentum, slowing economic growth, declining consumer confidence, inflation, political rancor and flagging mental health are creating a socio-economic malaise that will undermine the efficiency and deflationary growth that has driven record equity prices for the last decade. This economic transition from a deflationary to an inflationary cycle correlates with the great rotation […]

Tellurian Inc.: A Disruptive Energy Transition Speculation

LNG will power the global decarbonization transition. Tellurian is a potential game changer. Tellurian will export low-cost US LNG to high-priced international markets. Is Charif Souki energy’s Elon Musk? Tellurian Inc. (NASDAQ: TELL) could be a clean energy disruptor much like its predecessor Cheniere Energy, Inc. (NYSE: LNG). Charif Souki is the Executive Chairman of […]

The Fed’s Transitory Inflation Argument Debunked.

The August 2020 Federal Reserve Jackson Hole meeting produced a generational shift in monetary policy in which the central bank abandoned its staunch 40 year inflation-fighting posture. Income Growth Advisors, LLC (IGA) has been warning of higher interest rates, since then, and 10-year US Treasury yields have been rising, except during the recent month’s Delta […]

The Greater Fool Theory and Jenga Mirror Today’s Market

Current market valuations are extreme, but overvaluations can persist for long periods before a market peaks. Today, several negative factors are increasingly weighing on the market, while the benefit of the economic recovery is increasingly being fully discounted into the market. At some point, like the game of Jenga, the market’s impressive bull market will […]

Major Warning Signs Point to Market Top

The US stock market is forming a major market top. Valuation measures, price charts, decelerating earnings in leading tech stocks, broad-based margin deterioration, inflation, rising interest rates, and rising taxes are increasingly weighing on equity valuations. These growing negative factors are balanced against the massive liquidity which has pushed valuations to historically high levels. The […]

Delta Variant Pauses Reflation Cycle

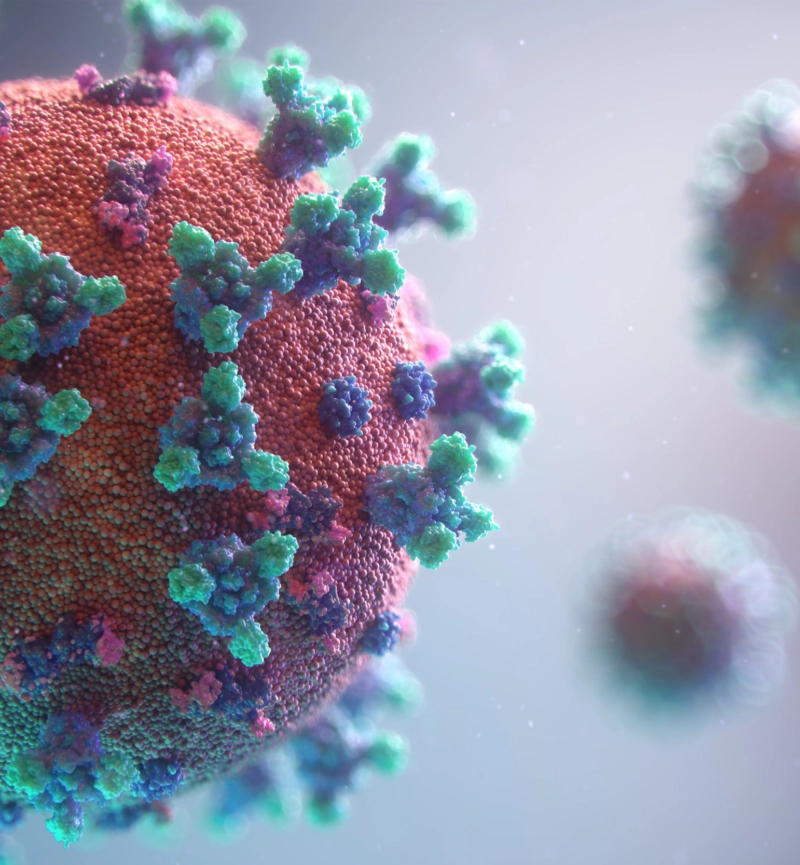

COVID-19 is still the leading global market factor Rising interest rates pause with Delta Variant Great Rotation could drive 800% outperformance Inflation could torpedo benign interest rates Natural Gas is an energy leader The COVID-19 pandemic and its media coverage have driven the world’s markets since January 2020. The pandemic has been the primary fundamental […]

Inflation Drives the “Great Rotation”

Strong economic growth and inflation are persistently driving the “great rotation” from growth stocks to cyclical stocks. Were it not for the historically low Treasury yields, which make stocks attractive by comparison, the S&P 500 stock index’s overvaluation would be problematic. As vaccination levels rise toward herd immunity, economic activity is rapidly recovering. Vaccinations in […]

Rising Rates Drive Inflationary Market

Interest rates are rising rapidly, ending a 40-year bond bull market and shifting the economy from deflationary to inflationary. Rising interest rates are replacing COVID-19 as the main factor driving global economies and markets in 2021. Our September forecast for rising interest rates in our Two Generational Trends Reverse letter is proving to be timely […]