Blue Chip Total Return

Larger Capitalization MLP's are Established with Attractive Yields.

Blue Chip Total Return investors are seeking to maximize their income streams by investing in a portfolio of large durable midstream MLPs.

We choose those MLPs that are large established businesses with attractive yields and growth potential. This profile will forfeit distribution growth for business durability. We typically have 8 MLP holdings in a profile. To augment our security selection process, we developed quantitative models to identify the most attractive MLPs from those which would qualify for Blue Chip Total Return.

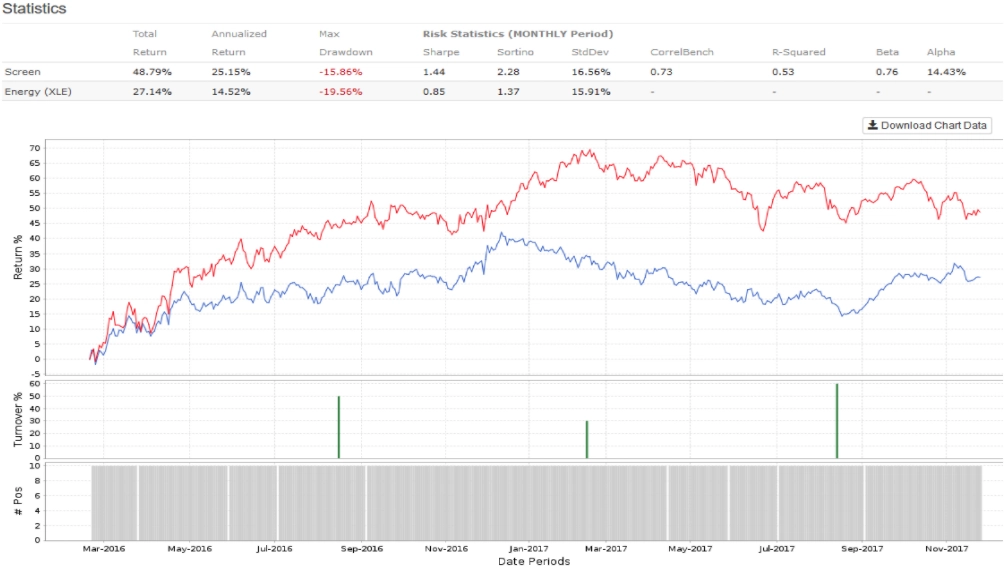

Below is a back-tested return profile based on our proprietary quantitative rules and inputs since March 2016 when oil and the sector and bottomed. We use quantitative methods to identify factors that explain performance but are careful not to use those characteristics which historically fit, but are not forward looking. The Blue Chip Total Return model below reflects a 25% annualized return which outpaces the XLE energy index which annualized 14.52%. This model has an alpha of 14.43%, a sharp ratio of 1.44 and lower maximum draw-down than the XLE benchmark.

Representative Blue Chip Total Return Holdings

Enterprise Products Partners, LP (EPD) is one of the largest most diversified master limited partnerships in the United States. Its market cap is $53.9 billion and it yields 6.87% and has paid 77 consecutive quarterly distributions. EPD has grown significantly since its IPO in July 1998, increasing its asset base from $715 million to $52 billion at December 31, 2016. Their tremendous growth is a result of expansions from organic growth opportunities, as well as acquisitions. EPD provides midstream energy services to producers and consumers of natural gas, natural gas liquids (NGLs), crude oil, refined products, and petrochemicals in the United States and internationally. EPD has 71,000 miles of natural gas, crude oil, natural gas liquids and refined products pipelines traversing 36 states. It also operates approximately 4,250 miles of refined products pipelines; and terminals, as well as provides refined products marketing and marine transportation services. The company was founded in 1968 and is based in Houston, Texas.

Energy Transfer Partners, LP is (ETP) is one of the largest Master Limited Partnerships in the United States with one of the most diversified portfolios of energy assets totaling more than 71,000 miles of natural gas, crude oil, natural gas liquids and refined products pipelines traversing 36 states. ETP’s market capitalization is $19.1 billion, yields 14.9% and has an enterprise value of $51.8 Billion. The company’s assets are strategically positioned in all of the major U.S. production basins. ETP owns and operates natural gas midstream, transportation and storage assets; crude oil, natural gas liquids (NGL) and refined product transportation and terminalling assets; NGL fractionation; and various acquisition and marketing assets. ETP’s CEO and chairman of the board is Kelcy L. Warren. ETP’s general partner is owned by Energy Transfer Equity, L.P. (ETE)

Williams Partners, LP (WPZ) is a master limited partnership and premier provider of large-scale infrastructure connecting the growing supply of North American natural gas and natural gas products to growing global demand for clean fuels and feedstock. WPZ owns, operates, develops, and acquires natural gas, natural gas liquids and oil gathering systems, and other midstream energy assets in the United States. It focuses on natural gas and natural gas liquids gathering operations. The company provides gathering, processing, treating, and compression services to producers under long-term fixed-fee contracts. WPZ has a $36.1 billion market capitalization and yields 6.8%. In February 2015 Williams’ acquired Access Midstream Partners and merged it with Williams Partners which enhanced its exposure to key production basins in North America. The merger combined Access Midstream’s expertise in the gathering and processing with the breadth of Williams’ capabilities across the broader natural gas value chain.

Price and Yield data as of 12/1/2017

Invest with Income Growth Advisors

Create a financial road map for your investment objectives and risk tolerances.

Your bespoken investment plan awaits!