Aggressive Growtn

MLPs Which Offer the Highest Return Potential, but Whose Risk Profiles are Above Average.

Aggressive Growth MLPs may be restructuring stories, highly leveraged or deeply oversold opportunities.

A variety of factors may an MLP an aggressive growth holding which should experience returns far in excess of the MLP benchmark. We select these opportunities to generate above benchmark returns. These companies typically have higher debt levels or are turn around or restructuring, they typically are perceived as being riskier than the average MLPs but we see an improving story.

We typically have 8 MLP holdings in a profile. To augment our security selection process, we developed quantitative models to identify the most attractive MLPs from those which would qualify as aggressive, though this category has more diverse business profiles.

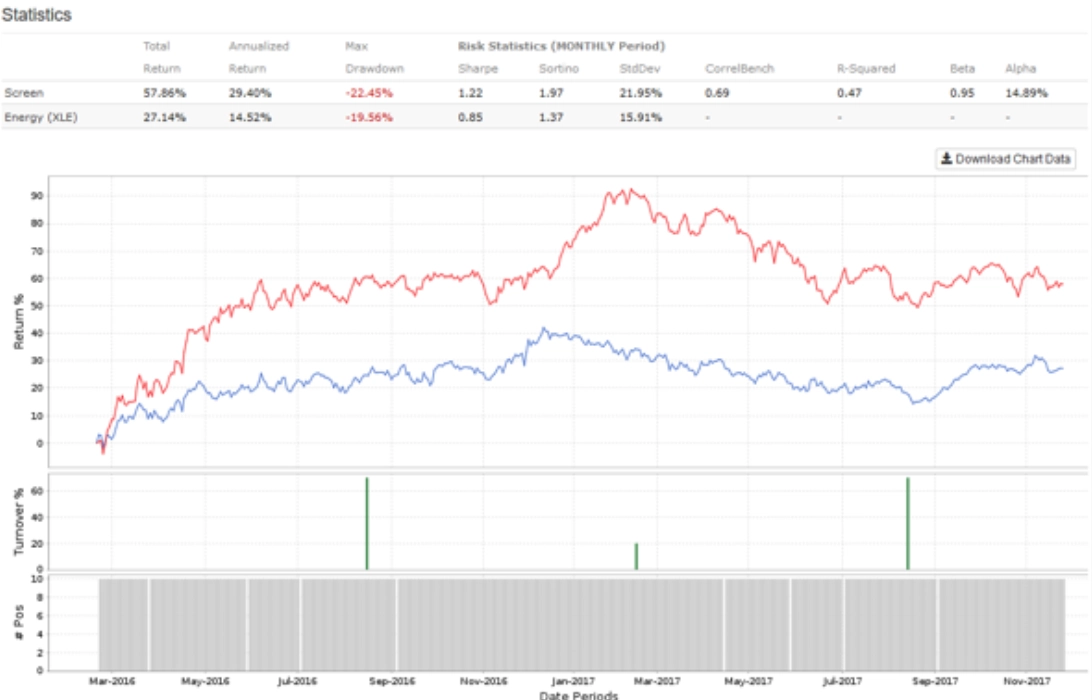

Below is a back-tested return profile based on our proprietary quantitative rules and inputs since March 2016 when oil and the sector and bottomed. We use quantitative methods to identify factors that explain performance but are careful not to use those characteristics which historically fit, but are not forward looking. The Aggressive model below reflects a 29.4% annualized return which outpaces the XLE energy index which annualized 14.52%. This model has an alpha of 14.89%, a sharp ratio of 1.22 but a higher maximum drawdown than the XLE benchmark.

Representative Aggressive Holdings

American Midstream Partners, LP (AMID) provides midstream infrastructure that links the producers of natural gas, crude oil, natural gas liquids (NGLs), condensate, and specialty chemicals to various intermediate and end-use markets in the United States. The company recently merged with JP Energy and is actively restructuring. AMID does not have a traditional parent, but is funded and supported by ArcLight Capital Partners, LLC a private equity firm that has invested in over $19 billion in energy assets. AMID owns approximately 4,000 miles of interstate and intrastate pipelines, as well as ownership in gas processing plants, fractionation facilities, and an offshore semisubmersible floating production system with nameplate processing capacity of 80 thousand barrels per day of crude oil and 400 million cubic feet per day of natural gas. AMID has terminal sites with approximately 6.7 million barrels of storage capacity. American Midstream Partners, LP has a market capitalization of $642 million, a 12.4% yield and was founded in 2009 and is headquartered in Houston, Texas.

Calumet Specialty Products Partners, L.P. (CLMT) produces and sells specialty hydrocarbon products in North America. It is a restructuring led by a new management team and Timothy Go, a chemical engineer and former Exxon executive. CLMT operates in three segments: Specialty Products, Fuel Products, and Oilfield Services. The Specialty Products segment offers various lubricating oils, white mineral oils, solvents, waxes, synthetic lubricants, and other products which are used primarily as raw material components for basic automotive, industrial, and consumer goods. It is scaling back its exposure in the fuel products and oil field services divisions to focus on its higher margin niche specialty products division. The company has a $670 million market capitalization and it suspended its distribution two years ago. Calumet Specialty Products Partners, LP was founded in 1916 and is headquartered in Indianapolis, Indiana.

Antero Midstream GP LP (AMGP) is a Delaware limited partnership that will elect to be treated as a corporation for U.S. federal income tax purposes. AMGP owns, operates, and develops midstream energy assets in the Marcellus and Utica Shales two of the most productive shales in the country. The company, through its assets, gathering pipelines, compressor stations, processing and fractionation plants, and water handling and treatment systems provide midstream services to Antero Resources Corporation (AR) under long term fixed-fee contracts. AMGP is a leveraged investment in Antero Midstream Partners (AM) by owning all of AM’s Incentive Distribution Rights “IDRs.” AMGP was formerly known as Antero Resources Midstream Management LLC and changed its name to Antero Midstream GP LP in May 2017. Its market capitalization is $3.53 billion, has a distribution yield of 1.36% and has a distribution growth rate in excess of 30% annually. Antero Midstream GP LP was founded in 2013 and is headquartered in Denver, Colorado.

Price and Yield data as of 12/1/2017

Invest with Income Growth Advisors

Create a financial road map for your investment objectives and risk tolerances.

Your bespoken investment plan awaits!